Summary

Recent crypto market volatility offer greater trading opportunities [2024]

Overview

Research and trading firm established 2011, in Singapore.

The firm runs quantitative investment strategies (QIS) including:

- Factor strategies

- Alternative Risk Premia strategies

- Pure Alpha strategies

Strategic Approach

Since July 2022 the firm established its presence in the cryptocurrency space and has developed a number of strategies allocating to spot and derivatives markets including its flagship market-neutral carry strategy and relative value volatility.

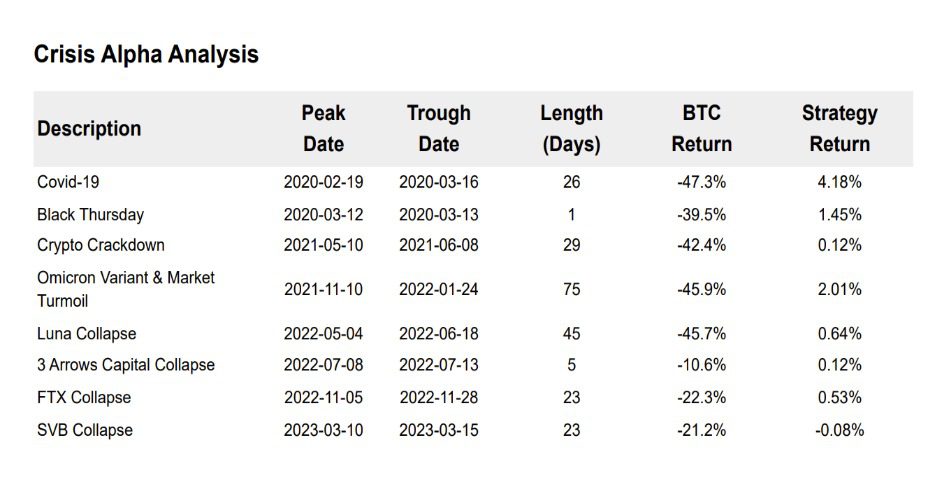

Strategies tend to have higher risk-adjusted returns and lower drawdowns than typical long-only

strategies, making them attractive on a standalone basis or as a portfolio diversifiers.

Background

Founder is CEO/CIO and oversees the R&D and implementation of the firm’s quantitative investment strategies.

Founder has >20 years of markets experience, running several billion dollars of cross asset quant strategies for institutional investors as head of quant investment strategies for names like Goldman Sachs and Barclays.

Funding

With >$2m already secured, AGX002 Capital is looking to raise ~$8m to scale up this market neutral strategy with a view to replicating stated

historical returns.

Strategy Description

Diversified Crypto Alpha Strategy

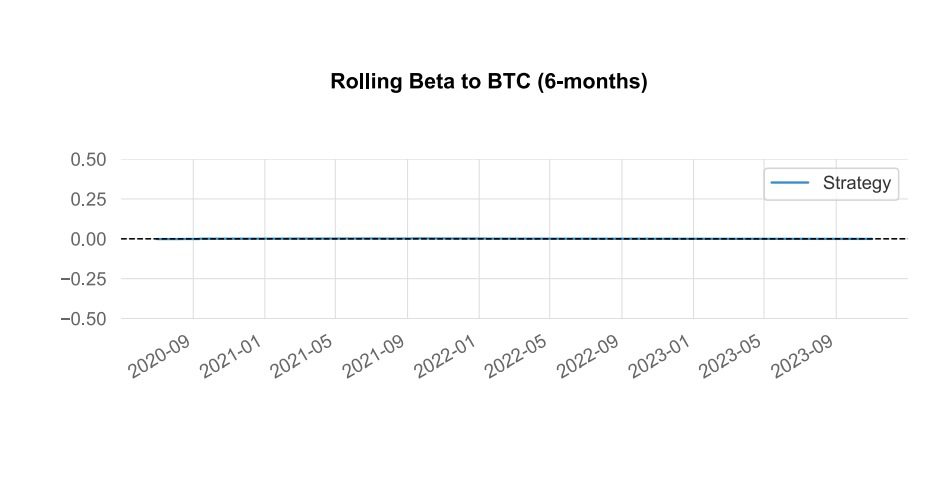

The AGX002 Diversified Crypto Alpha Strategy seeks to generate returns that are uncorrelated to the broad cryptocurrency market using a

quantitative investment approach.

The strategy allocates to a diversified portfolio of alphas including, carry, volatility, trend and mean-reversion.

The alphas are harvested through systematic trading in the spot, futures and options markets.

eg --> Market Neutral Carry Strategy USDT

The AGX002 Capital Market Neutral Carry Strategy USDT aims to earn an attractive carry in USDT terms with limited downside in all market

conditions. It systematically allocates to a long/short market-neutral basket of crypto spot and futures contracts. A proprietary selection mechanism

is used to identify the basket with the highest estimated forward carry, subject to concentration and liquidity constraints. The basket is rebalanced

on a regular basis, and the strategy can employ leverage from time to time, subject to strict internal maximum leverage constraints.

Key Performance Metrics

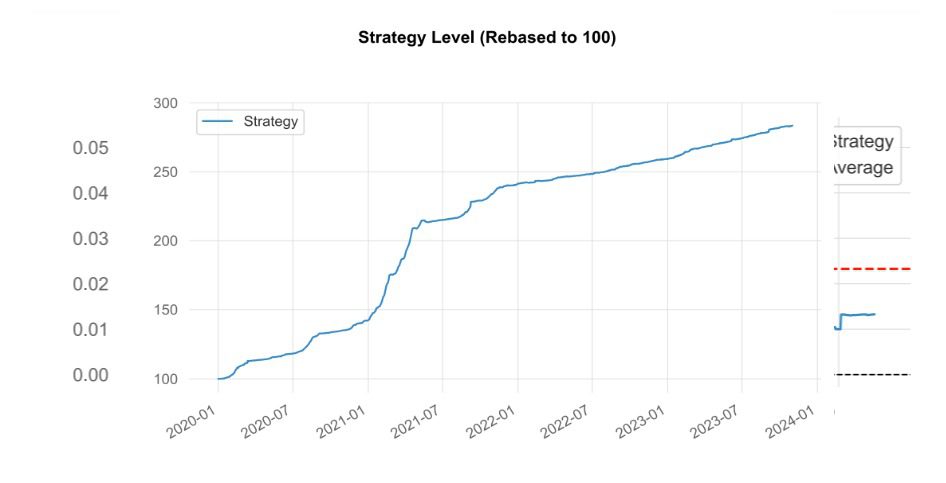

| Start Date | 01/01/2020 |

| End Date | 01/11/2023 |

| Total Return | 183.53% |

| Return (ann) | 31.22% |

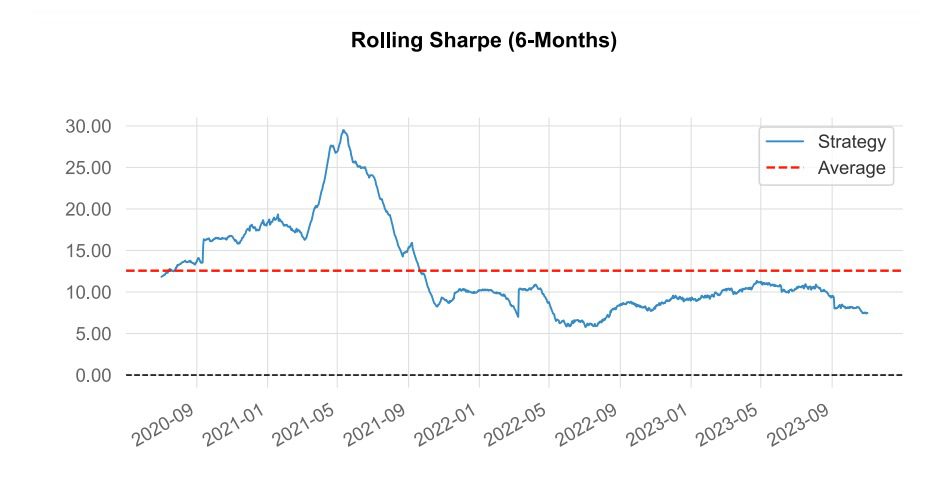

| Sharpe | 10.41 |

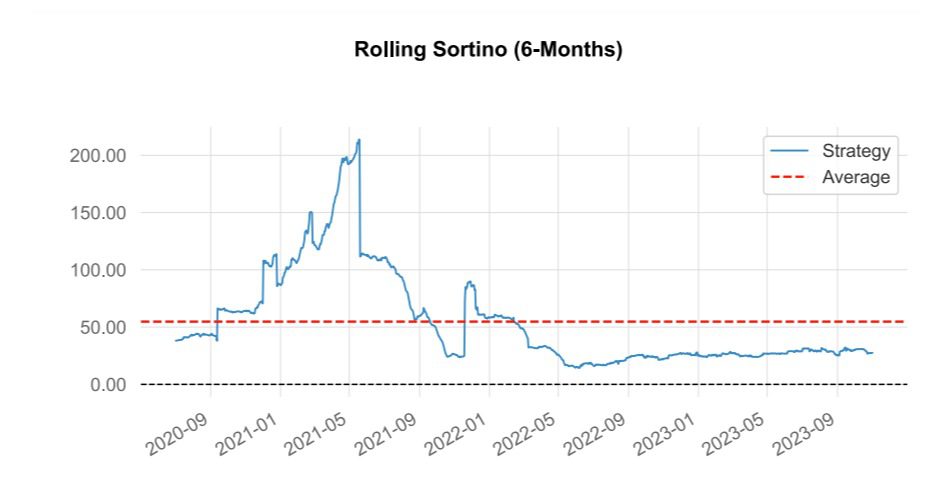

| Sortino | 50.28 |

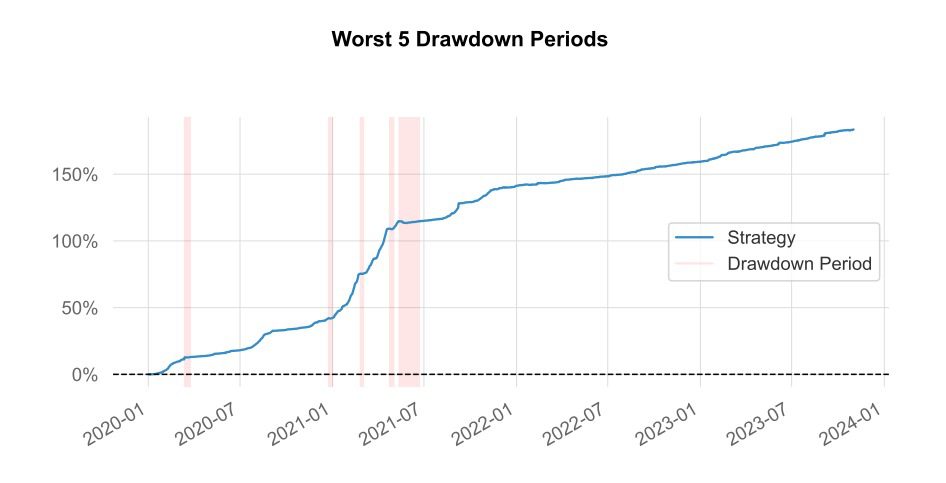

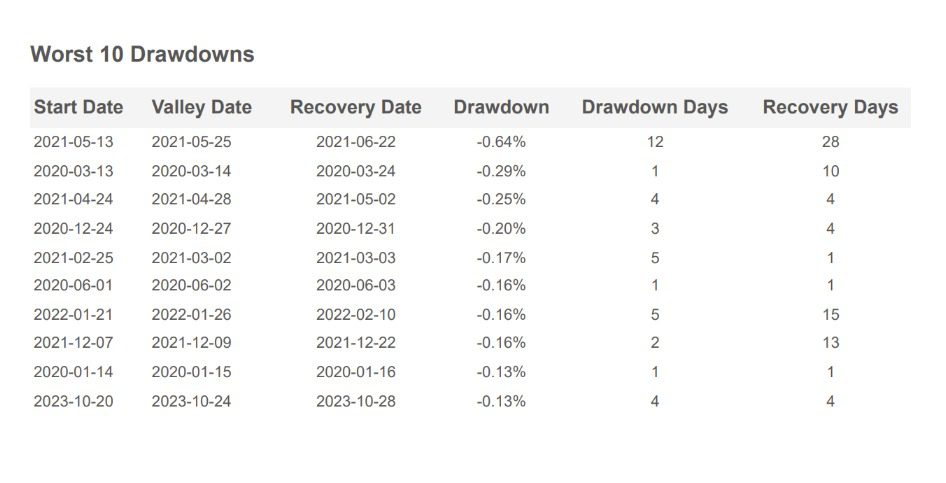

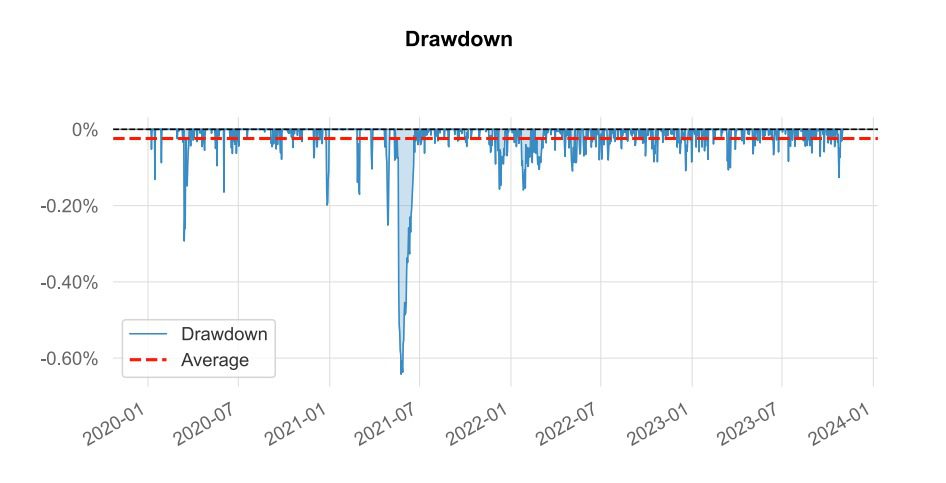

| Max Drawdown | -0.64% |

| Volatility (ann) | 3.00% |

Returns

| MTD | 0.06% |

| 3M | 2.53% |

| 6M | 4.94% |

| YTD | 9.40% |

| YTD (ann) | 11.35% |

| 1Y | 10.60% |

| 3Y (ann) | 27.74% |

| 5Y (ann) | 31.22% |

Other Analyses

Yearly Returns

| 2020 | 42.27% |

| 2021 | 69.61% |

| 2022 | 7.41% |

| 2023 | 9.4% (11.35% p.a.) |

Up-Down

| Avg Drawdown | -0.04 |

| Avg Drawdown Days | 2 |

| Avg Up Month | 2.70% |

| Avg Down Month | – |

| Win Days | 73.48% |

| Win Month / Quarter / Year | 100.00% |

Crypto Only - Managed Accounts

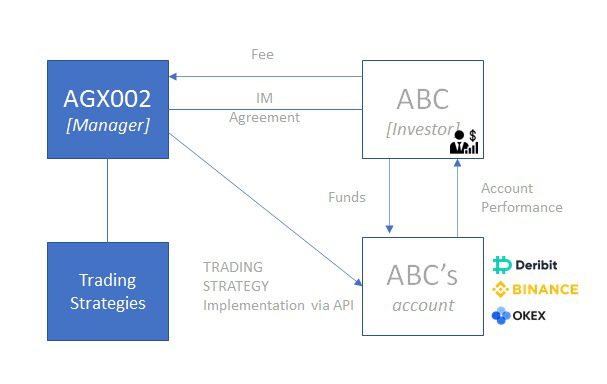

- ABC (the “investor”) and AGX002 Capital (the “Manager”) would enter into agreement whereby the Investor engages the Manager to implement an active trading strategy (the “Strategy”) in an Investor’s account (the “Account”) held at a cryptocurrency exchange (the “Exchange“).

- Such implementation would be done by submission of trading instructions electronically via the Exchange API.

The API features do not include the ability to withdraw or deposit funds in the Account (a trading-only API). - The Investor shall pay the Manager a fee for providing its service and such fee may comprise a fee linked to the Account’s value and/or the Account’s performance. The Strategy may allocate to any instrument that is part of the Eligible Instruments described below.

Disclaimer

This document is confidential. The information provided herein is for the exclusive use of the recipient. No part of the document may be reproduced, distributed or transmitted without the prior written permission of AMIGOlife or AGX002 Capital. The information herein are subject to change at any time without notice.

The strategy performance is backtested and is net of estimated transaction costs comprising estimated bid/ask spread and commissions. Any past or simulated past performance (including backtesting) contained herein is no indication as to future performance.

This material does not constitute or form part of an offer or invitation to issue or sell, or of a solicitation of an offer to subscribe or buy, any securities or other financial instruments, or enter into any other financial transaction, nor does it constitute an inducement or incitement to participate in any product, offering or investment.

The information contained on this document is not financial or investment advice. It should not be understood or construed as such. Niether AMIGOlife nor AGX002 Capital are financial advisors and will not provide any advice and the information contained on this document is not a substitute for financial advice from a licensed advisor. The information in this document does not constitute tax, legal or investment advice and is not intended as a recommendation for investing in any financial products.

AMIGOlife and AGX002 Capital provide no guarantees with regard to the content and completeness of the information and does not accept any liability for losses that might arise from making use of the information.

Neither AMIGOlife nor AGX Capital (nor any of its directors, officers, employees, representatives or agents), accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein.

THIS DOCUMENT IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE AT ANY TIME WITHOUT NOTICE